Pay your revolving credit balances as much as you can.If your credit score is currently too low to qualify for PayPal credit, there are steps you can take. Do not apply for PayPal Credit without secure financial backing. If you fail to make payments on time or carry a high balance, this could negatively affect your credit score. But, frequent hard inquiries in a short period of time will harm your score.Īlso, be sure that you’re in a financial position to pay off any purchases made with a PayPal credit account. In general, one or two hard inquiries do not greatly impact your credit report. Hard inquiries remain on your credit report for an average of two years.

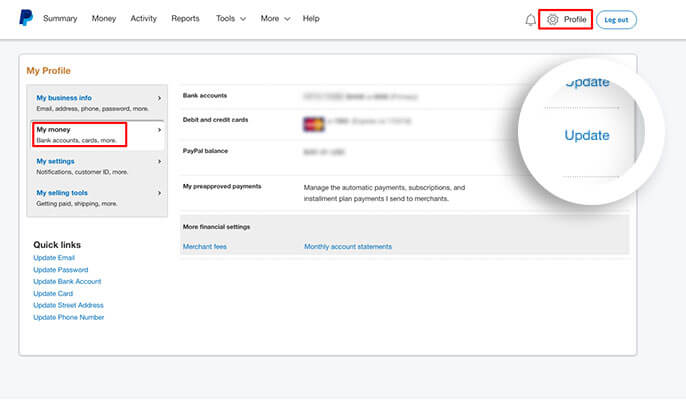

Does PayPal Affect Your Credit Score?Īs discussed above, applying for PayPal credit will affect your credit score, creating a hard inquiry. Take these factors into consideration before applying. Additionally, approval for PayPal credit is not guaranteed just because you have a preexisting PayPal account. However, even if you have a PayPal account, applying for PayPal credit will still result in a hard inquiry on your credit report. These invites are sent via email to qualified PayPal customers with a good payment history through PayPal. If you have a PayPal account but don’t yet have a PayPal credit account, you will likely receive an invitation to apply for one. Additionally, this new line of credit can even be linked and utilized before the actual card arrives in the mail. This allows them to use PayPal credit as a primary payment option anytime they go to make a purchase. Approved applicants can then link their PayPal credit card right to their PayPal account. Within seconds, PayPal’s credit approval system alerts borrowers whether they have been approved. Be sure to consult with a credit specialist before proceeding with your application.

Knowing the credit score needed for PayPal credit will help you determine if this creditor is the right fit for your financial and lending needs.

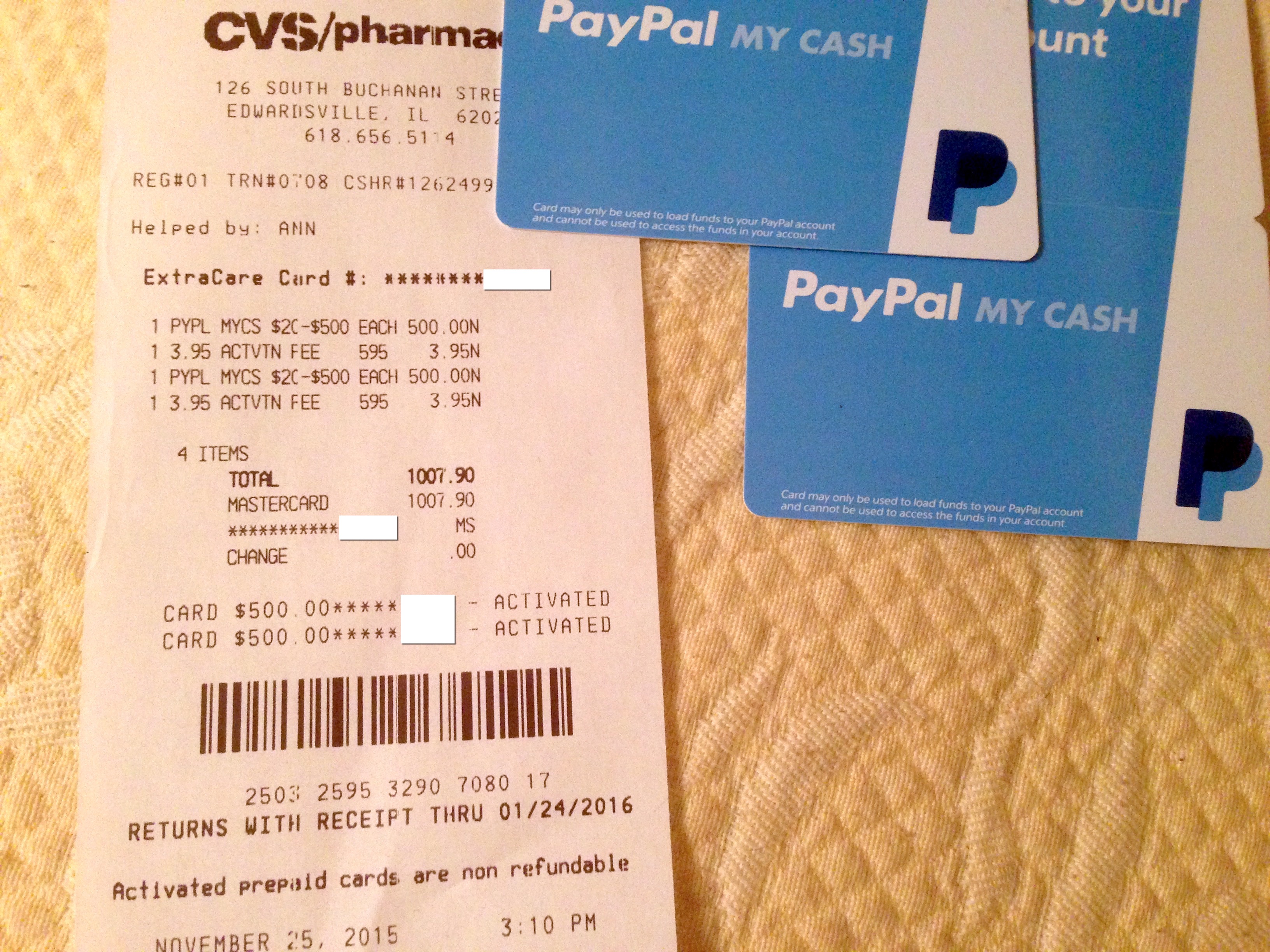

Let’s take a dive into how PayPal credit works, and what it takes to qualify for PayPal lending. However, did you know PayPal also offers their own credit and lending services? Purchases range from large and small businesses alike. Many consumers use PayPal as their preferred payment platform to purchase goods and services.

0 kommentar(er)

0 kommentar(er)